Budgeting Process in Public Sector

Isabelle Joumard is a Senior Economist in the Economics Department of the OECD. The development of multi-year plans and budgets is likely to improve predictability in the sectors resources.

Chart 2 Public Sector Current Receipts 2019 20 Budgeting Receipts Income Tax

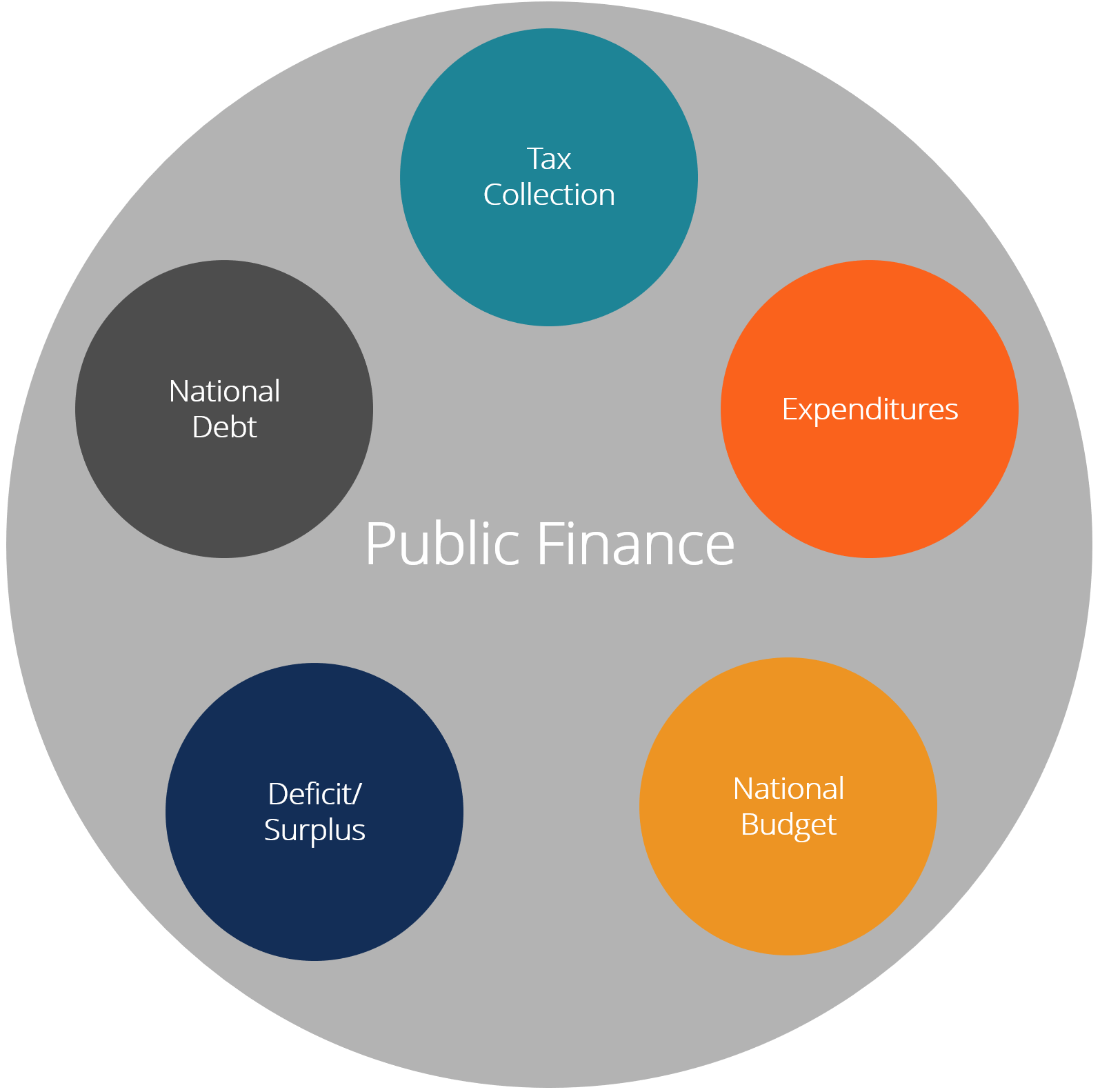

Unquestionably taxpayers and donors have an interest in knowing where the money is spent.

. The Treasury first issued the Guidelines for Setting Charges in the Public Sector in 1999. OPSI champions wholescale change and helps governments find ways to turn the new into the normal so that innovation is not accidental but strategic and systemic. 2 of a budget implies that a set of decisions have been made by school board members and administrators which culminate in matching a schools resources with its operational needs.

It evaluates the benefit accruing. IDG has worked for USAID and other international donors for over 30 years on more. Measuring value is therefore a big dilemma.

It mainly focuses on the expected results rather than the funding levels which leads to optimum use of resources in both the public and the private sector. The school occupies the No. That is that charges are efficient and effective and that stakeholders have visibility over the costs that underpin the.

Monitoring evaluation and learning. IT categories broken out into discrete entries that roll up to summary view. The same could be said of value.

And institutional support contracts. Through the universitys prestigious Voinovich School of Leadership and Public Affairs students gain an understanding of public-sector budgeting while also building skills in policy leadership business management and communications. I compared private-sector and public-sector efforts to one group running a sprint and another running an obstacle course.

You mention the issue of budget. International trade policy and facilitation. Participatory budgeting is a form of citizen participation in which citizens are involved in the process of deciding how public money is spent.

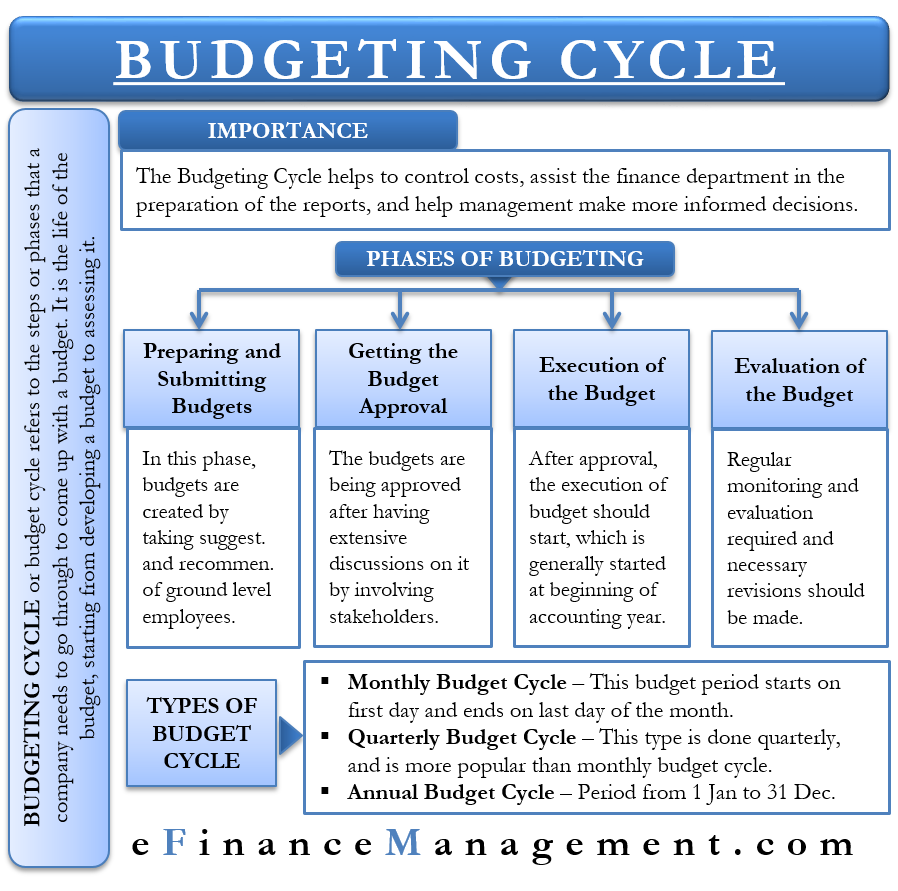

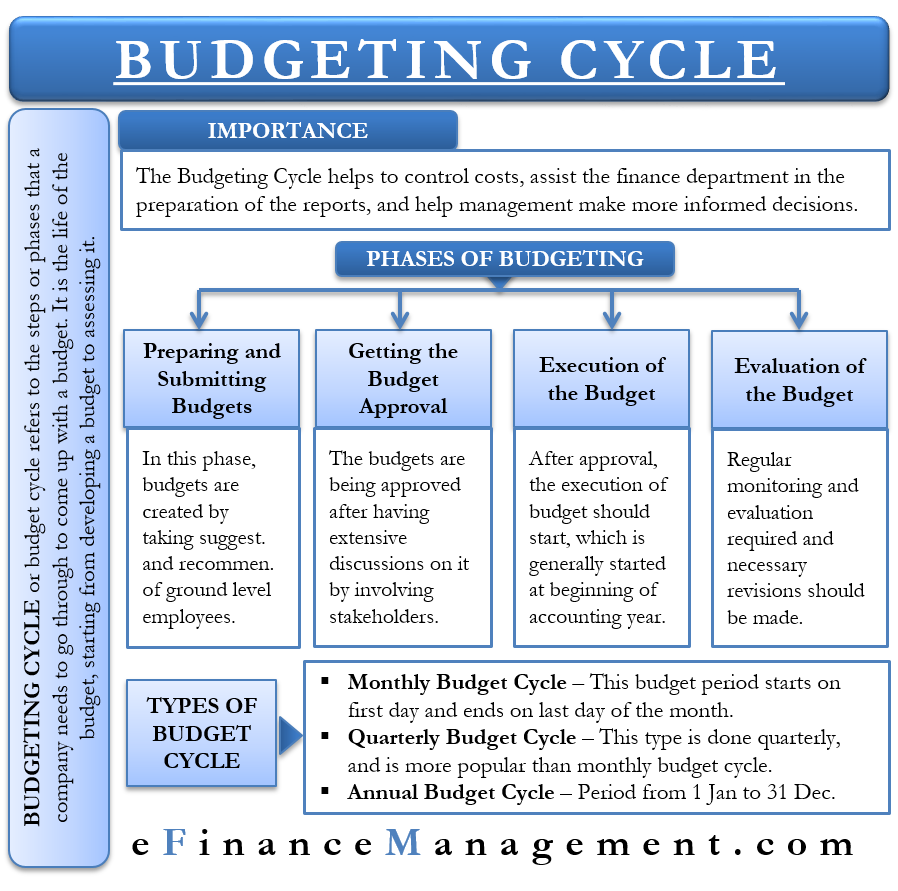

When the country introduced medium-term sector strategy MTSS in the budgeting system we were happy because we believe if it is followed the way it is. In the public sector especially measuring value is one of the most contested area. Budget preparation is a process with designated organizations and individuals having defined responsibilities that must be carried out within a given timetable see Figure 1 in Section 1 for a typical time line.

Download the free IT budgeting template to streamline the IT budgeting process and gain confidence in the output. Web services APIs application and data connectors allow MAGIQ applications to. The outputinput budgeting method is often used by governments to show the relationship between the taxpayer funds input and the output of services provided by the state and federal governments.

This latest review of the guidance has been prompted by Ministerial interest in ensuring an open book approach is applied to cost recovery charges imposed by the public sector. Costs of participatory budgeting can vary anywhere between 400 and 40000 depending on the size and the scope. 18 spot in the SR Education Groups 2020 Best Online Colleges Offering MPA.

With Questicas cloud-based budgeting software you have everything you need in one easy-to-access place. Elemental services include infrastructure eg. Teresa Curristine is a Policy Analyst in the Public Governance and Territorial Development Directorate of the OECD.

Food security and agriculture. If the health budget is. We are excited to announce that Upper Murray Family Care UMFC have selected MAGIQ Performance as their financial budgeting and reporting solution.

Budget of Expenditures and Sources of Financing BESF Mandated by the Constitution this contains the macroeconomic assumptions public sector context including overviews of LGU and GOCC financial positions breakdown of the expenditures and funding sources for the fiscal year and the two previous years. At the Summit four themes were adopted one of which was More jobs better jobs decent work for all. Created from IT budgeting best practices.

The employees have to quantify a particular goal based on the priority and the taxpayers money. The budget also provides an important tool for the control and evaluation of a school districts. Evaluation of an LEAs operations than in those of the private sector.

The Expanded Public Works Programme EPWP has its origins in Growth and Development Summit GDS of 2003. Public-sector adaptions of the Harvard model all draw on a roughly similar sequence of activities while recognizing that following a strict order is often not feasible necessary or desirable. While generally sharing broadly common.

The public sector is that part of the economy controlled by the government. The GDS agreed that public works programmes can provide poverty and income relief through temporary work for the unemployed to carry out socially. National Expenditure Program NEP.

Automates the calculation of fully-burdened employee costs. Local people are often given a role in the scrutiny and monitoring of the process following the allocation of budgets. Enable data-driven budgeting and decision-making while increasing data accuracy saving time and improving stakeholder trust.

Our projects generate cutting-edge insights surface exemplary case studies and best practice and build skills. This article was produced for the German Presidency of the European. Our end-to-end budgeting software is used by local governments non.

Adoption of a budget in the public sector implies that a set of decisions has been made by the governing board and administrators that culminates in matching a governments. Roads healthcare for the poor and aging eg. In health proactive engagement of health ministries in the budgeting process can facilitate alignment of budget allocations with sector priorities as laid out in national health strategies and plans.

Zsuzsa nna Lonti is a visiting academic in the same directorate. What is value to me may be meaningless to you depending on where you sit and what your expectations are. Budgeting is the process of allocating finite resources to the prioritized needs of an organization.

Public Sector Cloud SaaS Software Easy-to-use financial administration software. Now all departments have the latest figures and reports. In schools the adoption.

Private-sector development and market systems. Theyre heading to the same. This process is normally established and controlled by a legal and regulatory framework.

Our areas of expertise include. MAGIQ Cloud ERP Integration Framework. For over 20 years Questica has partnered with public sector organizations to enable data-driven budgeting and decision-making while increasing data accuracy productivity and improving.

In most cases for a governmental entity the budget represents the legal authority to spend money. People in government are unbelievably talented and there is an underappreciation for how hard their operating environment is because of the bureaucracy regulations and added process steps. It is said that beauty is in the eyes of the beholder.

In the public sector organization and not-for-profit organization a performance budget helps to increase accountability. Budget process performance budgeting. Value for Money VfM in the public sector.

Budgeting Cycle Meaning Importance Phases And More

Chart 1 Public Sector Spending 2019 20 Budgeting Social Services Government

Public Finance Overview Example How Government Finance Works

No comments for "Budgeting Process in Public Sector"

Post a Comment